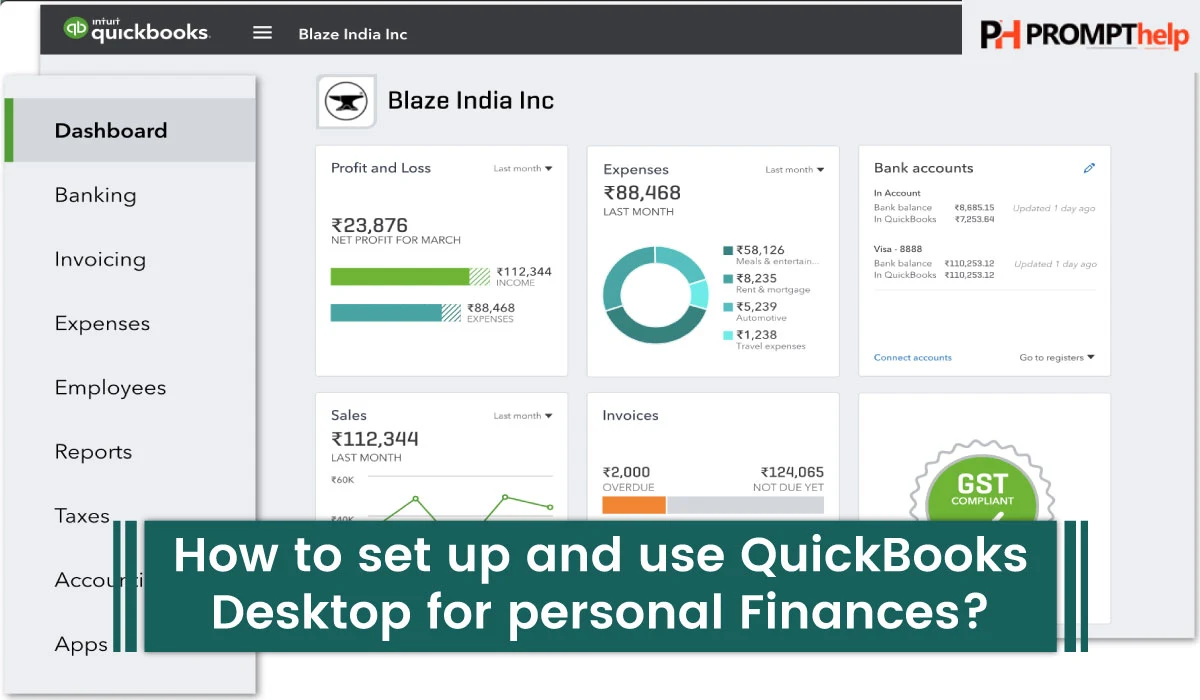

How to set up and use QuickBooks Desktop for personal finances?

Most businesses run on QuickBooks, but the software isn’t just for tracking payroll and invoicing — it’s also a powerful tool for managing your personal finances. While QuickBooks Desktop is primarily marketed to small businesses, individuals and households can benefit greatly from its robust budgeting, expense tracking, and reporting features.

In this article, we’ll walk you through how to set up and use QuickBooks Desktop for managing your personal finances — including bank accounts, expenses, and budgeting.

💼 Why Use QuickBooks for Personal Finances?

QuickBooks Desktop offers several advantages over traditional budgeting apps:

-

Tracks all financial accounts in one place

-

Allows custom reporting and categorization

-

Provides professional-level insights into spending

-

Supports goal setting and cash flow management

-

Enables easy tax preparation and tracking

If you’re looking to get serious about your money, QuickBooks gives you the tools to analyze and control it with precision.

🛠 Step 1: Setting Up QuickBooks Desktop for Personal Use

1. Create a New Company File

Even though you’re not running a business, QuickBooks requires a company file.

-

Open QuickBooks Desktop

-

Click File > New Company

-

Choose “Start Setup” or “Express Start”

-

Enter a name like “Personal Finances”

-

For industry type, choose “Other/None”

This will allow you to bypass business-specific features like customer invoicing.

🏦 Step 2: Add Your Bank Accounts

-

Go to Lists > Chart of Accounts

-

Click Account > New

-

Choose Bank, name the account (e.g., “Checking – Bank of America”)

-

Repeat for other accounts like savings, credit cards, loans, etc.

You can now use QuickBooks to track deposits, withdrawals, transfers, and account balances.

💳 Step 3: Enter Income and Expenses

You can manually enter transactions or import them via .CSV files.

Manually:

-

Go to Banking > Write Checks or Enter Credit Card Charges

-

Use categories like “Groceries,” “Utilities,” “Entertainment,” etc.

-

You can create custom categories in the Chart of Accounts

Automatically:

-

Use a third-party tool to convert your bank data into QuickBooks-compatible files (.QBO or .IIF)

-

Import transactions into QuickBooks using Bank Feeds

📊 Step 4: Create Budgets and Reports

-

Go to Company > Planning & Budgeting > Set Up Budgets

-

Choose the fiscal year and track by Account

-

Input your planned expenses (monthly or yearly)

Now you can run budget vs. actual reports to compare your spending.

Useful Reports for Personal Use:

-

Profit and Loss (P&L) – acts as a monthly spending report

-

Cash Flow Statement – helps plan for future expenses

-

Expense by Vendor/Category – shows where your money goes

✅ Tips for Using QuickBooks Effectively

-

Set recurring transactions for rent, subscriptions, and bills

-

Use Classes or Tags to separate different life areas (e.g., Kids, Travel, Home)

-

Reconcile bank accounts monthly for accuracy

-

Backup your company file regularly

⚖️ QuickBooks Desktop vs. Personal Finance Apps

| Feature | QuickBooks Desktop | Personal Apps (e.g., Mint, YNAB) |

|---|---|---|

| Customization | ✅ High | ❌ Limited |

| Advanced reporting | ✅ Yes | ❌ Basic |

| Budgeting tools | ✅ Manual setup | ✅ Automated |

| Learning curve | ❌ Steeper | ✅ Easy |

| Cost | 💲 One-time or yearly | 💲 Often free/subscription |

If you’re already familiar with QuickBooks or want total control of your finances, QuickBooks Desktop is a smart choice.

🧠 Final Thoughts

While most people use QuickBooks for small business accounting, it’s a hidden gem for managing personal finances. With a bit of customization, QuickBooks Desktop can help you track every dollar, plan for the future, and gain deep insights into your financial habits.

If you’re serious about personal budgeting and financial planning, QuickBooks Desktop is worth considering — especially if you’re already using it professionally.